Tax Services for Individuals

Get tailored help for your unique tax situation. Services include tax planning sessions to plan the best way to cut future tax bills and preparation of your Form 1040 and any related IRS forms.

Income Tax Preparation Options

We offer two convenient options for professional income tax preparation to meet your needs. Both options provide the same high-quality service and include electronic filing of all tax returns.

Option 1: 100% Virtual Tax Preparation (Recommended)

Our fully virtual service is the most efficient and economical way to have your taxes prepared. This option utilizes a secure, easy-to-use online platform that allows clients to upload documents, communicate with their preparer, and review their return from anywhere. Clients also enjoy 24/7/365 access to their tax files for added convenience and peace of mind.

Option 2: In-Person Drop-Off & Pick-Up

For clients who prefer limited in-person interaction, drop-off and pick-up appointments are available on a limited basis and by appointment only. Due to the additional handling and processing involved, this option includes a nominal processing surcharge.

New Client Intake Requirement

All new clients are required to schedule a New Client Intake appointment prior to the preparation of their tax return. This appointment is conducted online or by phone and allows us to review your tax situation, confirm required documents, explain the preparation process, and ensure we provide the most accurate and efficient service.

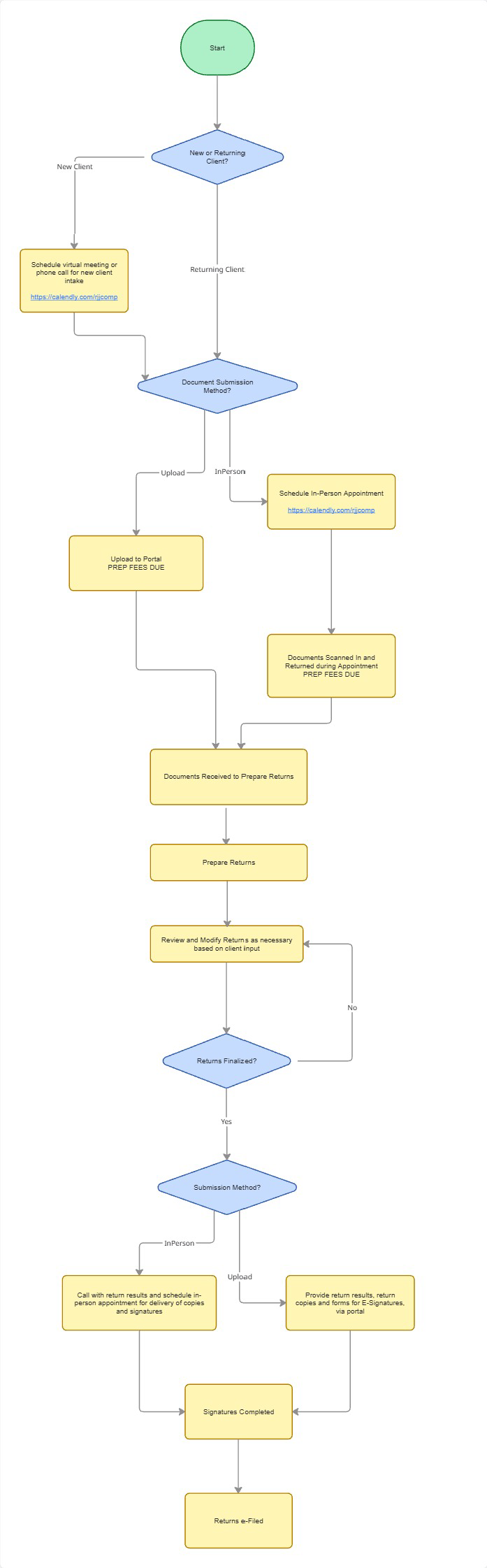

The step-by-step tax preparation process for both options is outlined in the chart below. All completed tax returns are electronically filed for fast, secure submission.